Meaning of book profit as per explanation 1 to section 115jb 2 book profit for the purposes of section 115jb means net profit as shown in the statement of profit and loss prepared in accordance with schedule iii to the companies act 2013 as increased and decreased by certain items prescribed in this regard.

Meaning of book profit for mat computation.

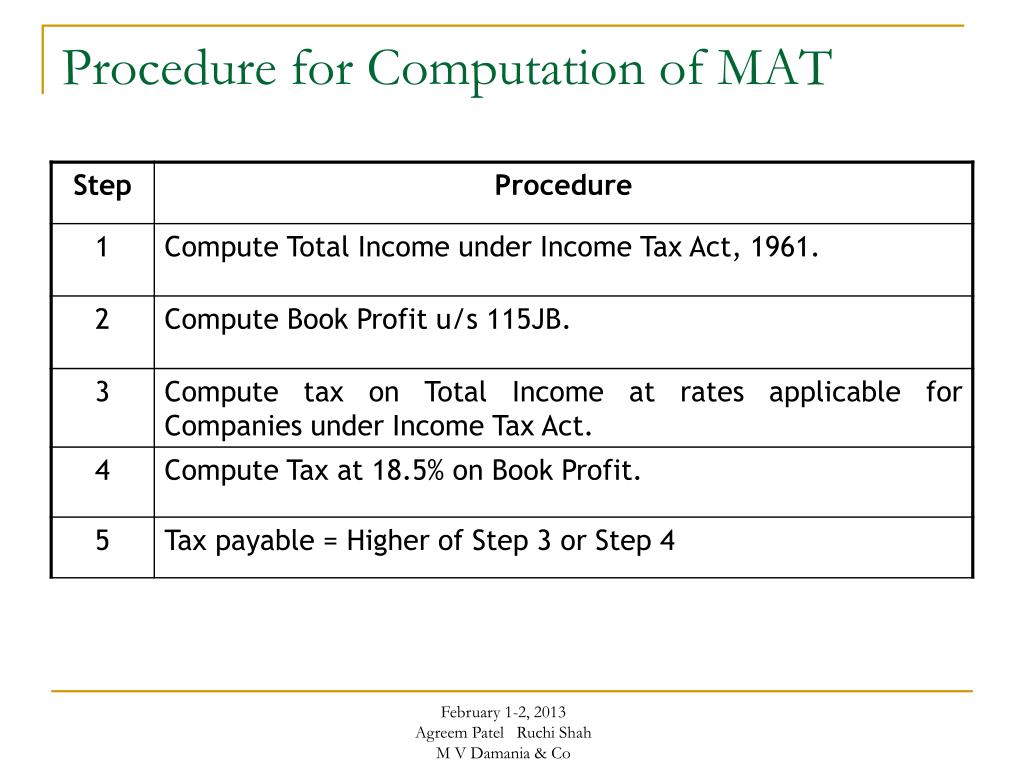

For fy 2019 20 tax payable is computed at 15 previously 18 5 on book profit plus applicable cess and surcharge.

The mat provisions begin with a non obstante clause and thus are a sacrosanct and self contained code.

Book profits as per section 115jb 1 01 00 000.

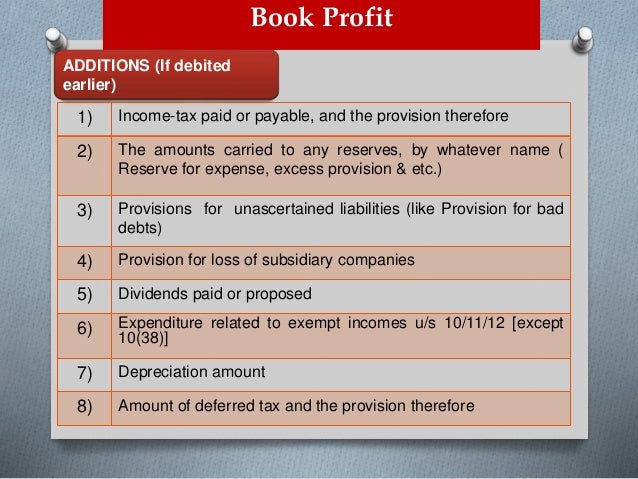

A the amount of income tax paid or payable and the provision thereof.

In other words it refers to money earned by an entity during a financial year by selling products and services deducted by all the expenses incurred during the same financial year.

Minimum alternate tax mat.

Means the tax payable on the basis of normal computation of total income of the company.

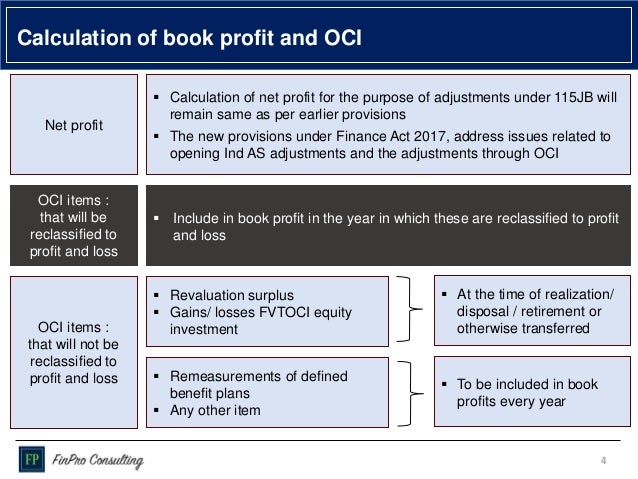

Step 1 find out net profit before other comprehensive income oci as per statement of profit and loss of the company.

Mat is levied at the lower rate of 9 plus surcharge and cess as applicable for companies that are a unit of an international financial services centre and derive their income solely in.

Mat credit will be allowed to carry forward facility for a period of 10 assessment years immediately succeeding the assessment year in which mat is paid.

Unabsorbed mat credit will be allowed to be.

Mat provisions require book profit to be adjusted against lower of brought forward unabsorbed loss and unabsorbed depreciation and not merely restrict the amount set off to the lower number august 21 2018 in brief in a recent ruling1 of the ahmedabad bench of the income tax appellate tribunal tribunal an issue.

Computation of book profit.

Calculation of book profits for the purpose of mat maximum alternate tax section 115jb for computation of book profit one may proceed as follows.

Step 1.

Book profit means the net profit as shown in the profit loss account for the year as increased and decreased by the following items.

The net profit as shown in the profit and loss account prepared as per part ii and iii of schedule vi for the relevant fy shall be increased by the following if debited to the profit and loss accounts.

In other words the mat provisions in section 115jb create a deeming fiction which deems book profit as the total income of a company for determining its tax liability.

Mat is equal to 18 5 15 from ay 2020 21 of book profits plus surcharge and cess as applicable.